A nuclear power plant and its cooling towers. Source: nuclear regulatory commission

Excellent news! I figured out inline LaTeX in wordpress, so my equations look even more baller.

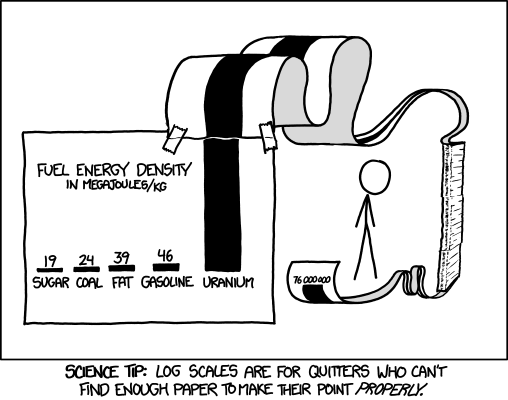

If you had to guess how many pounds of coal you needed to equal the power output of a single pound of uranium for a nuclear reactor, what would you guess? 100 pounds? 1000? Try 3,000,000 pounds of coal to equal the energy in one pound of uranium. The energy contained in a nuclear reaction is immense. In a timely fashion, XKCD recently made a post about this:

XKCD comic about log scales. More importantly, it shows uranium is gigantically more energetic than coal. Also, note that my coal calculation have more power than his. It's cause I assumed a better burning, cleaner coal in order to be nice to coal. It's old and it's days are numbered, so we should be nice to it, no? Check out xkcd.com

This will be a three part series about nuclear power. This post gives a very brief description of how a nuclear reactor works. The next two will be what happened in Chernobyl and Fukushima, and another on how the newest generation of nuclear reactors are much more safe than the older ones.

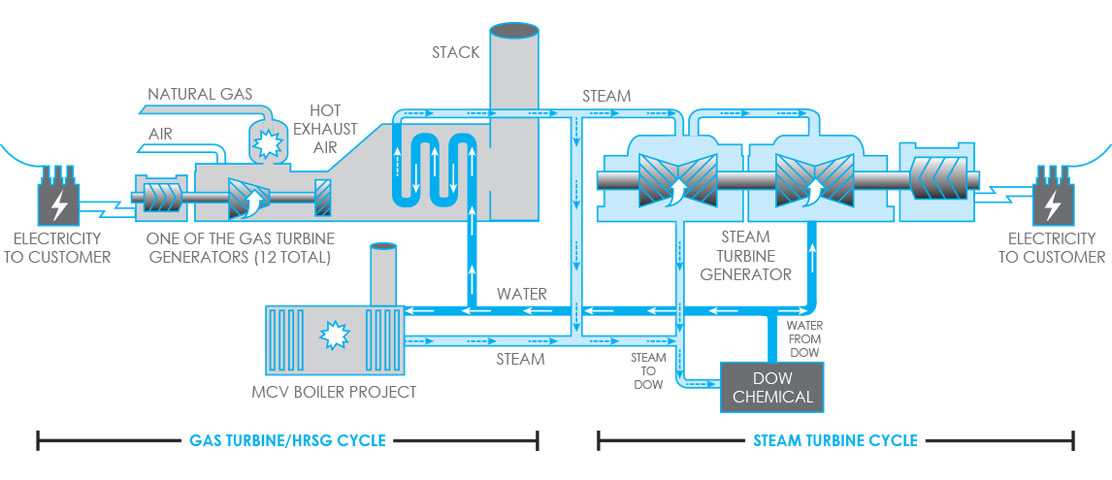

A nuclear power plant is basically your standard steam or thermal power plant. Except that it is surrounded by a ton of protection to prevent or contain explosions and nuclear fallout. Unfortunately, Cold War Russia forgot all this protection, which is why Chernobyl turned into a huge mess. Fortunately, Fukushima did have these protective measures, and no one got lethally dosed. More on this in a future post.

First, some math!

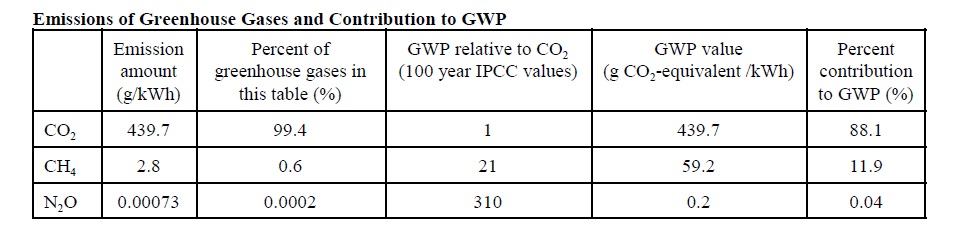

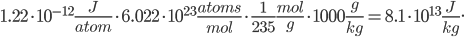

In the coal post, we showed that (extremely high quality) coal contains 34MJ per kg. Let’s figure out how much energy is in a kg of uranium!

We learned as kids that mass and energy are conserved. They are related by Einstein’s equation E=MC^2. When a nuclear reaction happens, the mass of resulting elements are lower than the mass of the starting elements. This energy has to be released as heat. For a nuclear reaction of U-235, ~202 MeV are released (eV is electron-volts, a unit of energy) per atom.

Seriously, how good does this math look right now?

This doesn’t sound like much, considering coal has  . Lets continue with maths.

. Lets continue with maths.

Remember Avogadro’s number?  ? It’s the number of molecules to make X grams of a molecule, where X is the atomic mass. It turns out the atomic mass of U-235 is 235. Funny how that works, right?

? It’s the number of molecules to make X grams of a molecule, where X is the atomic mass. It turns out the atomic mass of U-235 is 235. Funny how that works, right?

Hokay.

This is 2.4 million times the energy density of very good coal. It is closer to 3.5 million times the energy density of coal that is typically used to generate electricity.

Nuclear power!

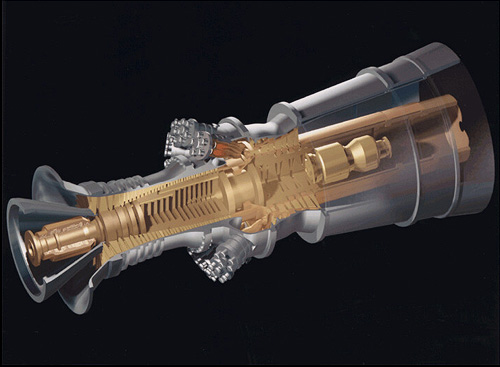

A nuclear power plant is a thermal power plant. It harnesses the heat of a nuclear reaction to create steam.

Uranium-235 decays naturally, releasing the massive amount of energy described above. One of the decay products, a neutron, can hit another U-235, causing that to decay. Each decay produces several neutrons. The process becomes a chain reaction that can grow exponentially.

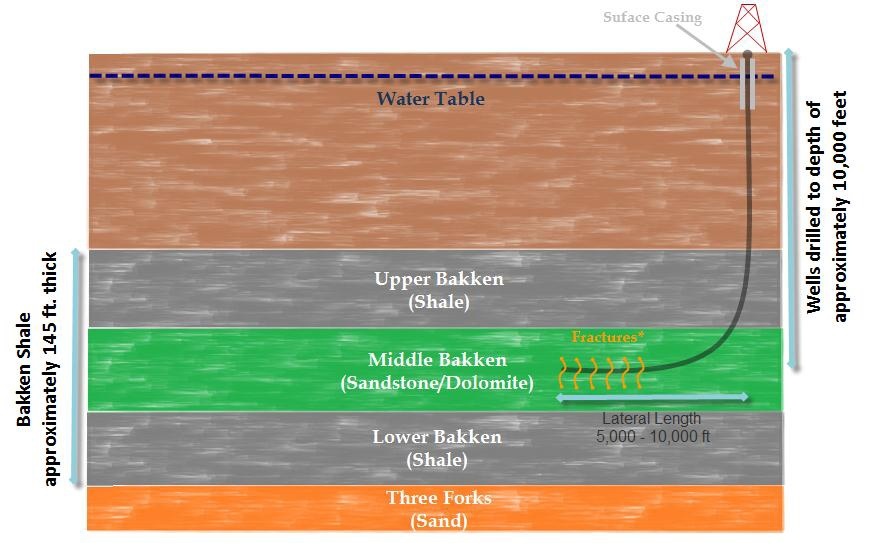

U-235 is formed into pellets, and then into rods, which are put in the reactor core. The decays produce heat, which is absorbed by water, which then drives the steam cycle. To prevent a runaway reaction, control rods are inserted between the U-235 rods. These control rods absorb neutrons from the nuclear decay. Once absorbed, these neutrons cannot break another U-235. The reaction becomes controlled.

That is pretty much it. There are a ton of safety measures beyond this, however.

These reactions are contained within a reactor pressure vessel. The vessel is designed to contain the reaction. To reduce maintenance, these pressure vessels need to be a single piece. Currently only Japan, Russia, and China have the capability of building the massive pressure vessels needed for nuclear power plants. South Korea will have this capability within the next year.

Another NRC picture. Schematic block diagram of a nuclear reactor. A pressure vessel that is a single piece requires less maintenance.

The pressure vessel is the second line of defense against a reactor meltdown, after the control rods. Outside of this is a huge concrete containment structure that allows the pressure vessel to survive an earthquake, bomb, or airliner crash. It also prevents the escape of nuclear gases in the event of an accident. Chernobyl did not have one of these. All current nuclear powerplants do, making Chernobyl a non-repeating event.

A nuclear plant will produce about 20 metric tons of nuclear waste per year. The waste cools in a pool for spent fuel rods for a couple of years before being mixed with glass and stored in massive concrete cooling structures.

Can Nuclear Power Alone Replace Fossil Fuels? Unfortunately, probably not in the short term.

If the US wanted to replace all of its fossil fuel electricity with nuclear power in the next 20 years, it would have to build a lot of nuclear power plants. The US currently uses more than 250GW of installed capacity of fossil fuels for electricity. If this grows at 3% per year, we will need more than 450GW of power from this source. We would need to build 450 1GW nuclear reactors in 20 years, or nearly one every two weeks. Considering we haven't built a nuclear reactor from start to finish in over four decades, this is not an immediately solution. We have to get on building nuclear right off if we want this to be any sort of solution.